I now take you back to the village because it is a beautiful way to comprehend how humans built-up systems, including money systems, to create a civilised society. If we break too many of the systems previously set up, we will break civilised society. We are breaking the marriage system, food systems, religious guidance and possibly other systems. In this book, I discuss one part of the money system. There are books to come on the other systems set up by our ancestors and how we are destroying our civilisation for self interest. Here we deal with one particular abuse of our money system. Our ancestors invented a token system to enable trade. It was a remarkable system and without it civilisation was not possible. The most obvious is that food cannot be grown in the countryside and transported to cities without a money system. In our village, an authorising authority must issue tokens and ensure their use. The authority must issue them on adequate volume to enable free-flowing trade, but not to create an oversupply. The authority must have a method of removing excess tokens from society. This was traditionally by means of taxation, but has been replaced with ‘interest’ to the moneylenders as the moneylenders have created the dominant component of the Money Supply. Our simple society consisted of onion sellers, egg sellers, apple sellers and more. The introduction of tokens enabled the onion seller to create more onions and purchase a greater volume and array of other goods and even some luxury goods. The family of the egg seller no longer needed to overindulge on egg meals. The money authority had the tricky task of maintaining an appropriate volume of tokens in society. It is not easy to detect when more tokens are needed. There is no red light that flashes to say: “Top up Money Supply”. I am really not quite sure how the authority would detect this. I doubt that they ever got it correct. There is a very big difference in the token supply needed in a village that passes its money on a daily basis and a village that passes its money on a weekly basis. One needs seven times the number of money tokens compared to the daily spending village all for the same average annual turnover. Anyway, our village chief blunders along as best he can and spends into society and he taxes to get money out of society. He reaches 1000 tokens supplied. He detects a problem when the onion seller starts to hoard tokens. The chief issues more tokens to compensate. The onion seller eventually removes tokens equivalent to half the total supply. The chief gradually doubles the Money Supply to compensate for the hoarding. So the token supply is now 2000 with 1000 hoarded by the onion seller. No inflation has occurred as a consistent 1000 tokens continues to circulate. The chief has added 1000 tokens at no cost. How much are the onion-seller’s tokens worth? Work it out, before I try to answer. The token supply went from 1000 to 2000 at no cost to the chief. Answer: I have not found a straightforward answer. By the issuers instructions, the tokens are equal in value to each and every other token, but if the onion seller spends them in one day he vastly exceeds the daily turnover in tokens but also doubles the number of tokens in circulation. If we assume a velocity of approximately twelve, the money is turning over once a month, making the daily turnover equal to 1000/30. The onion seller exceeds the daily turnover by a factor of thirty whilst doubling the money in circulation. This amplifies problems. The very nature of money does not tolerate this type of situation. It demonstrates that the whole concept of money has inbuilt flaws that will never be fixed. Money is imperfect and humans will always struggle with a money system. Money is an essential component of civilisation and, at the same time, has irreparable flaws. We have to make the most of this imperfect system. In our onion seller example, we get a conundrum that I shall illuminate:

Our issuer, who is the chief, issues tokens and instructs his tribe to use said tokens as a temporary store of a previous transaction’s value to be held over to another transaction. There is no specification on how long the token will be held until the next transaction. Even in our village it could be one day or one week. Over a whole society, the volume of transactions will even out over a given period. No business copes well with violent changes in turnover. As a computer consultant who also runs businesses, I have often explained that business works best on a steady turnover. Even a doubling of turnover in a short term creates all manner of problems, including staff overload and its consequences, and much more. Where the length of holding money between transactions is unpredictable or erratic as with the onion seller, the money system does note cope. The onion seller cannot spend all his hoardings, equal to half the Money Supply, in one day without creating financial turmoil. He cannot even spend the hoard over one month because it would double the Money Supply. Minor variations in the Circulating Money are easy to accommodate, but gross movement is destructive. The human instinct to better one’s situation, when not restrained by a good moral system from a religion, is likely to cause the individual to act for his own benefit rather than the health of the money system. The hoarder will hoard for a better future without realising he is damaging the very money system on which his welfare and the value of his hoard relies. His Hoarded Money only has value if it is released back into circulation very slowly or the issuer removes tokens at the same rate or someone else hoards Circulating Money at the same rate. The system is not self correcting. It is not tolerant of hoarding or rapid changes in turnover. Money system management, under such circumstances, is not easy.

Now let us look at some of the likely abuses of the system in the village:

Hoarding of tokens.

Rate of transactions is inconsistent.

Counterfeiting of tokens.

Fraud.

Extortion.

Bribery.

Political influence.

Other money systems might be set up.

Money would be lent.

Money would be lent expecting a greater amount in return.

Certificates acting as IOUs issued in place of genuine tokens by private money lenders.

Certificates issued for money that does not exist.

Certificates are lent by the money lenders where a greater volume of genuine money is expected in return.

Over issuance of certificates representing money tokens that don’t exist devaluing genuine tokens.

Certificates for non-existent money become more popular than genuine tokens.

Certificate lenders threatening the village chief with financial mischief if the village chief does not comply with their requirements.

Certificate lenders get the people in so much debt that the debt exceeds the money issued.

The system collapses when the moneylenders cannot extract more assets out of the citizens .

Hoarding is one of the worst things you can do with money. It completely removes money from circulation. It requires more tokens to be released. It is false saving as the Hoarded Money has no value. It creates instability. At high rates of hoarding the economy becomes extremely sensitive to minor changes in Money Supply and hoarding. High levels of hoarding also enhance the chance of an avalanche collapse into hyperinflation. Hoarding also encourages a competitive hoarding mentality where individual aspirations override community needs to the extent that laws and tax arrangements get biased towards the hoarder. Saving money is an evil, not a virtue.

The rate of transactions is inconsistent. Here we are talking about short-term variations in spending. In the modern world, this might occur at Christmas. Or Ramadan. I remember Ramadan in Egypt. All the shops were abuzz. I particularly enjoyed the rows of shoe shops selling high quality, locally made shoes. Christmas is similar in other countries. On a recent trip, the staff in airport shops in the Muslim country of Indonesia were wearing father Christmas hats and skimpy red clothes for the heat, whilst Christmas carols filled the air. Businesses do not cope with rapid changes to turnover even when they are predictable. Hired staff often do not know what they are doing and ask a million questions putting the management under stress. The money system is similar. Extra cash is required to top the ATM’s. I remember seeing queues out of the doors of UK banks just before Christmas. Big unexpected shocks can destabilise a perfectly functioning system. Witness the exchange rate changes when political events occur, such as the recent Brexit vote. Although, it must be remembered that the exchange rate is somewhat dependent on a fake system where 80% of the trade on Forex is conducted by speculators and only 20% has anything to do with trade between nations.

Counterfeiting of Money is fascinating. Fake tokens are created and put into circulation. Of interest, the fake tokens add to the Money Supply until they are detected. They cause a minor and steady increase in the supply of money and they become part of the Circulating Money. They actually do not cause harm whilst in use. They are gradually removed as they are discovered. One self appointed expert believes that even ATM’s occasionally dispense fake notes. Counterfeiting clearly undermines the issuing authority and needs to be curtailed but the damage is not as great as one might imagine. In reality the damage may be negligible or there may be a minor benefit if the genuine issuing authority is reluctant to issue sufficient notes. The British pulled a counterfeit stunt on the young U.S.A. They flooded the country with fake greenbacks. As citizens, we are led to believe that war is something that is fought with guns and physical force. In reality, war is constant and has many forms. The modern form is the control of the money system, finance, national debt, international debt, and media sources. The dirty tricks of the British were only going to work if sufficient notes were created. Small quantities would have merely boosted the Money Supply and possibly increased productivity. Large quantities would produce rampant inflation with the possibility of hyperinflation, loss of confidence in the paper money, loss of confidence in government and possible collapse.

Fraud is fraud. In law, fraud is a deliberate deception to secure unfair or unlawful gain, or to deprive a victim of a legal right. [1] This invariably involves money.

Extortion is interesting. Jesus was nailed to the cross because he objected to the money lenders monopolising the half silver-shekel in a manner to extort excessive local currencies from the less well off in a scam supported by the priests belonging to a separate class of society called the Pharisees. In our times, young persons have to buy housing off the older generation who are reluctant to downsize and are keen to maximise the property value. To do so, they, unfortunately, have to run to the money lenders, who through lending practices maximise the house property prices. The young then pay a high proportion of their incomes as interest on borrowed money that cost nothing to create to obtain their share of a freely created resource called land with some modest improvements upon it. Land was freely created by god or nature, as to your thinking, for all living things to share. The newest arrivals, whether they are migrants or children have to pay previous inhabitants a price inflated by bank lending of bank created credit. Governments also suffer. The government has the authority to create the money of the nation, yet is in debt to money lenders who run an army of excessively funded lobbyists who would not be lobbyists if they did not produce results in the favour of the money lenders. But the biggie is when money lenders refuse to renew (rollover) the bonds issued by the government unless certain conditions are met. This, I call ‘Bond Bribery’. A common extortion in current politics involves sexual compromise of lonely politicians far from home. A well-placed camera on a staged tryst will enable significant control. It would not be long before self-interested individuals or groups in our village resorted to extortion, both against other villagers or even the village chief. Even marriages are arranged to minimise the effects.

Bribery arrived with the invention of money. It is easier to bribe with money than with loaves of bread. In Western Australia, the $100 note is sometimes called a ‘Parker’ after a politician of similar name allegedly received bags full of $100 notes which got put under his desk. One can make bribery look legal by calling it lobbying. It is still bribery. Money for favours is bribery. If one can get a political outcome through the use of money that exceeds the power of the ballot box, then it is bribery.

Political influence. Money talks. I ask a little question. When a money lender lends money to a king, what happens when the king dies? Does the new king simply take over the debts of the old king or does the new king shout: “Off with their heads. They should not be lending under usury. It says so in the bible.”? Somewhat of a misinterpretation of the bible, but enough for the money lenders to want a more favourable lending environment. In reality, why was the king borrowing money when he had the authority to create money. The solution for a money lender is to get rid of the kings or reduce their power to zero such that they become a powerless figurehead. This was the outcome of the English Revolution. The French Revolution neutralised another king and the First World War got rid of a further five and prepared the way for the foreign-orchestrated Russian Revolution.

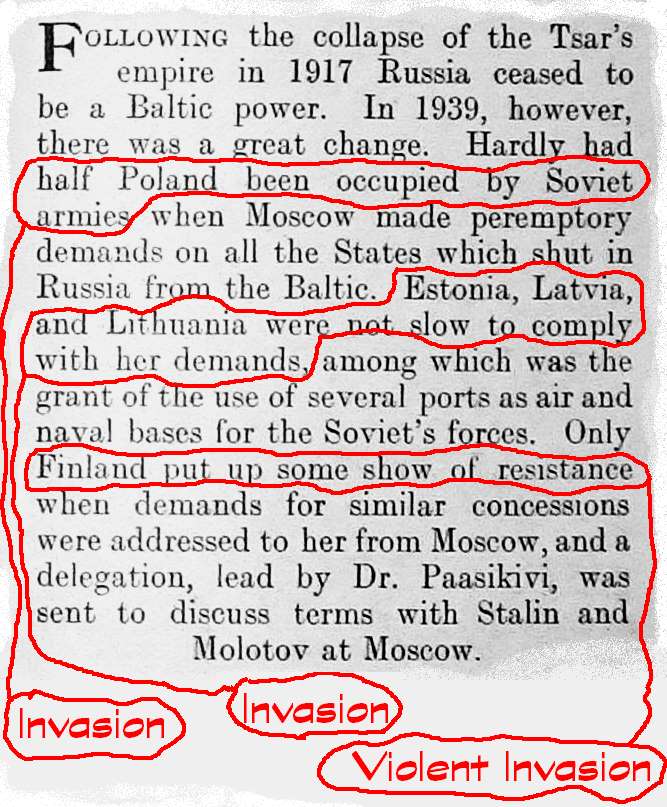

Other money systems might be set up. Rivals to the village chief will set up rival money systems. The modern world equivalent can be followed on TV in a twisted way. It is interesting that Muammar Gaddafi was keen to set up the ‘Pan African Dinar’. This was designed to become a money system for Africa. He wished to sell Libyan oil for the ‘Gold Dinar’ and to encourage all African and Middle Eastern governments to follow suit. Hjalmar Schacht, the currency commissioner, set up a new money system to stop the hyperinflation by creating a new Reich mark not backed by gold and equivalent to one hours work. He got his country flattened even though Russia had invaded Finland and half of Poland whilst Germany was only threatening to invade Poland. Clearly, the Russians were advancing towards Germany, yet we sided with the Russians rather than the Germans.

The above page is from the ‘The War Illustrated’ October 1939, that I found in my mother’s airing cupboard in Cheddar, England. You should be bright enough so change the words for Latvia, Lithuania, Estonia and Finland to ‘invasion’.

These countries are all close to Germany. Germany had not invaded any country at this stage but was portrayed as the ‘bad boy’ whilst Russia’s invasions were described as:

Money would be lent. Lending of money is an interesting topic. It is the lending of transaction value before one has earned the money. This makes sense for a business because business needs money before it can make money. Imagine that you are starting a new state in a remote territory. No business can operate whilst there are no citizens. When a few citizens arrive, they will probably go hungry as there is no business and they will have to fend for themselves without the knowledge or skills to do so. With a few more citizens, businesses can start, but they may not have any capital. It is prudent for the government to lend them money at zero interest to establish businesses. Money costs nothing to create and the government gains new business for the state and tax income from both the employees and the business. Business is not going to start without the availability of credit.

Money would be lent expecting a greater amount in return. This tends to create unpayable debt.

Certificates acting as IOUs issued in place of genuine tokens by private money lenders. Now the money lenders are getting sophisticated. The money lenders have been lending out genuine physical tokens. They now create a certificate stating that they will hold the tokens in a vault and request you to use the certificate in transactions. However, they issue more certificates than there are tokens in the vault. This actually works if the chief was tardy in issuing new tokens. The mild oversupply of certificates acts as money, even though they represent money that does not exist. How these certificates enter circulation is of interest. It may be because the citizens request their tokens to be kept in a vault. However, the money lenders were probably lending out money at interest for which they had no collateral in a vault. This takes us to through the next item (Certificates issued for money that does not exist.) and onto the following item.

Certificates are lent by the money lenders where a greater volume of genuine money is expected in return. When money lenders lend certificates and expect more in return we can reach a situation where all money and more is owed to the money lenders. In our village, the chief has issued two thousand tokens and the money lenders have amassed half of them. The lenders, lend their hoards to citizens at 10% interest. At the end of the year, the money lenders are owed 1100 tokens. Second year, they are owed 1210 tokens and the amounts follow this exponential series for twenty years are: 1000, 1100, 1210, 1331, 1464.10, 1610.51, 1771.56, 1948.72, 2143.59, 2357.95, 2593.74, 2853.12, 3138.43, 3452.27, 3797.50, 4177.25, 4594.97, 5054.47, 5559.92, 6115.91, 6727.50. So at the end of 20 years, there is 6727.50 owing to the money lenders of which 5727.50 is interest. Yet there is still only 2000 money tokens in existence. During the eighth year, tokens owing exceeds the total Money Supply. This means that the money lenders need to control the flow of information to avoid the citizenry observing the phenomenon.

Overissuance of certificates representing ‘money tokens that don’t exist’ devaluing genuine tokens. In the last example, the moneylenders have been lending money that exists. They extend this and issue more certificates than there are genuine tokens. These enter circulation by lending them to those prepared to pay a premium, which, in the end, means everybody. The original tokens become increasingly rare and the fake tokens dominate and it only costs ‘10%’ to borrow them. This graph tells most of the story:

| Exponential Interest on 1000 tokens at an interest rate of 10% | ||||

|---|---|---|---|---|

| Years | Available Tokens | Token Debt | Interest at 10% | Cumulative Interest |

| 0 | 1000.00 | 1000.00 | 0.00 | 0.00% |

| 1 | 1000.00 | 1100.00 | 100.00 | 10.00% |

| 2 | 1000.00 | 1210.00 | 210.00 | 21.00% |

| 3 | 1000.00 | 1331.00 | 331.00 | 33.10% |

| 4 | 1000.00 | 1464.10 | 464.10 | 46.40% |

| 5 | 1000.00 | 1610.51 | 610.51 | 61.05% |

| 6 | 1000.00 | 1771.56 | 771.56 | 77.16% |

| 7 | 1000.00 | 1948.72 | 948.72 | 94.87% |

| 8 | 1000.00 | 2143.59 | 1143.59 | 114.36% |

| 9 | 1000.00 | 2357.95 | 1357.95 | 135.80% |

| 10 | 1000.00 | 2593.74 | 1593.74 | 159.37% |

| 11 | 1000.00 | 2853.12 | 1853.12 | 185.31% |

| 12 | 1000.00 | 3138.43 | 2138.43 | 213.84% |

| 13 | 1000.00 | 3452.27 | 2452.27 | 245.23% |

| 14 | 1000.00 | 3797.50 | 2797.50 | 279.75% |

| 15 | 1000.00 | 4177.25 | 3177.25 | 317.72% |

| 16 | 1000.00 | 4594.97 | 3594.97 | 359.50% |

| 17 | 1000.00 | 5054.47 | 4054.47 | 405.44% |

| 18 | 1000.00 | 5559.92 | 4559.92 | 455.99% |

| 19 | 1000.00 | 6115.91 | 5115.91 | 511.59% |

| 20 | 1000.00 | 6727.50 | 5727.50 | 572.75% |

Certificates for non-existent money become more popular than genuine tokens. The village chief did not change with the times and many people preferred the paper certificates for tokens that did not exist because they were easier to use.

Certificate lenders threatening the village chief with financial mischief if the village chief does not comply with their requirements. The money lenders took little interest in the niceties of ethics. They were making vast fortunes by purchasing real assets from the proceeds of their scheme. After twenty years, they had an annual income of 5727.50 from an original investment of 1000 tokens. They had to wield significant political clout to keep the system going.

The system collapses when the moneylenders cannot extract more assets out of the citizens. The citizens en-mass refuse to pay the money lenders when others start to default. One big defaulter brings the whole system down as occurred in 1345 when King Henry refused to pay the Venetian bankers. Trying to collect 5727.50 from a monetary base of 1000 tokens is not gong to work. A mathematical limit is reached whence the system collapses.

Factors influencing the collapse are a study on their own. Clearly, a system with more debt is untenable as the debts can neither be repaid nor collected. Only so much tribute can be collected out of a debtor system. This Punjabi farmer was telling me about the suicide situation amongst farmers unable to pay their money dues. He was running local tours on top of farming to meet the dues:

The buffalo was like a pet and responded in the same way as a pet dog, which was much more interesting than finance. He enjoyed having his neck rubbed and head patted and would nudge for more attention. He trundled along slowly along his daily route until he saw a female buffalo, whence he took off at double speed. Farmers were resorting to suicide for their inability to pay part of the red out of the minimal supply of green. It is impossible to clear the red debt with green tokens. Yet not own of them would be aware of the situation. I was in the local shop that evening and the shop boy manually added up a shopping list in less time that I could read it and less time than a checkout machine can beep the prices, yet that mathematical ability had not spotted the impossible situation created by usury.

Anyone practicing the craft will be confined to the dustbin of hell. The minimum policy is to massively increase the tax on unearned income and remove all the cozy tax arrangements on unearned money and its attendant hoardings.

Over the years, this money system became the task of the sovereign. The money issuer was granted a godlike status in a hereditary arrangement. Under a monarch, money would get spent into society in an ad-hoc manner. The monarch would spend on national items and goods of his own need. To stop other individuals lending his money on credit, he would have supported a religion the banned the ‘lending of money and expecting a greater amount in return’ (usury). There was a problem with sovereigns and their money systems. Money was not always spent into society at a reasonable rate. Some kings spent lavishly on self-indulgent luxuries. A total ban on lending tends to dry up credit to business. Business needs money before it can make money. This is recognised in the Quran. It is not coincidental that the progress of the last three centuries coincides with the Church relaxation on usury. Unfortunately, the explosion in usury has ushered in an age of unpayable debt.